6 Modern Money Skills that Your Child Should Know

Buy 2700+ Pages Math Games & Activities (PreK-2nd Grade)

Modern Money Skills

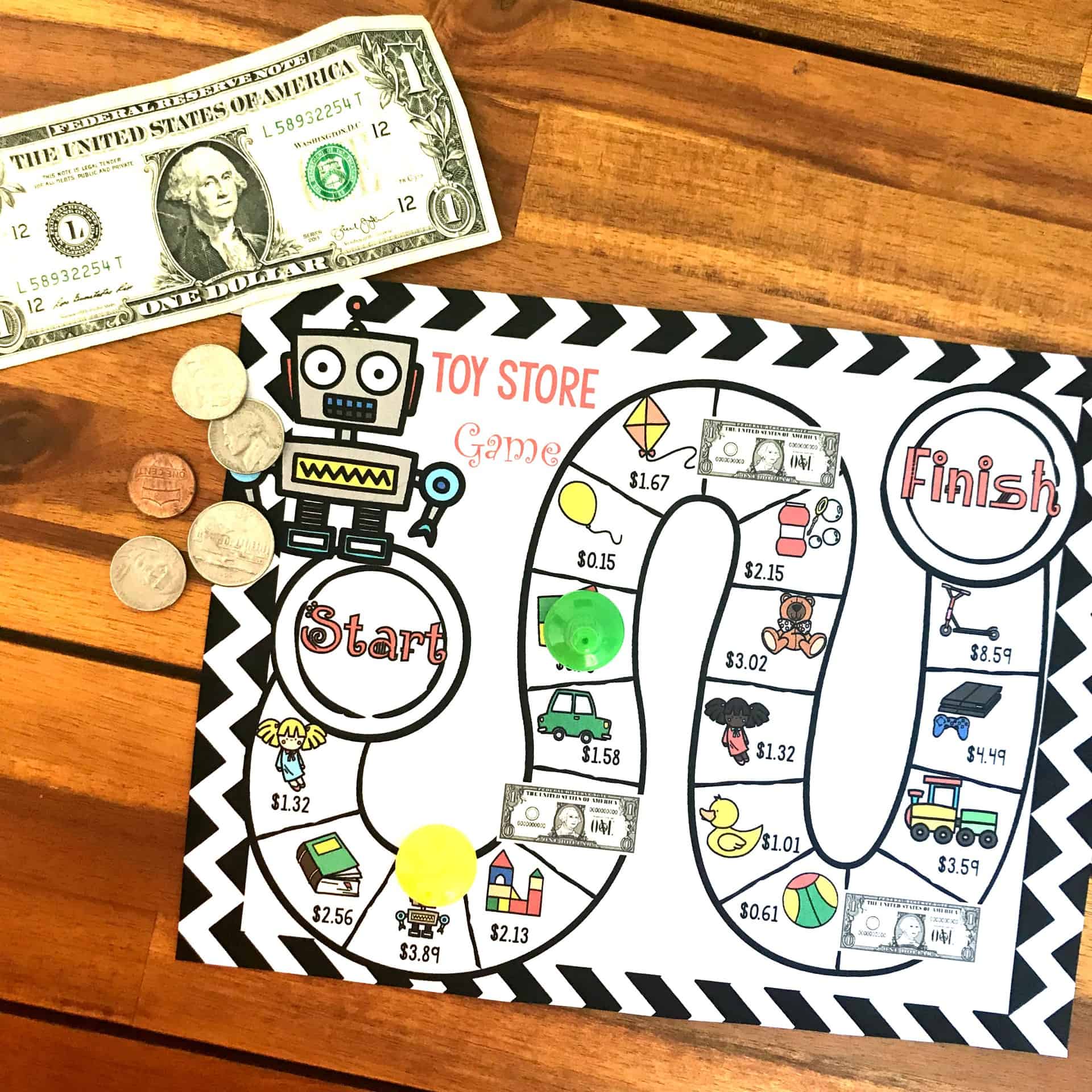

If you go to any elementary school math class, chances are, you’ll see lessons about money taking place. It’s the traditional stuff–dollars, coins, counting change, adding and subtracting money–all important stuff.

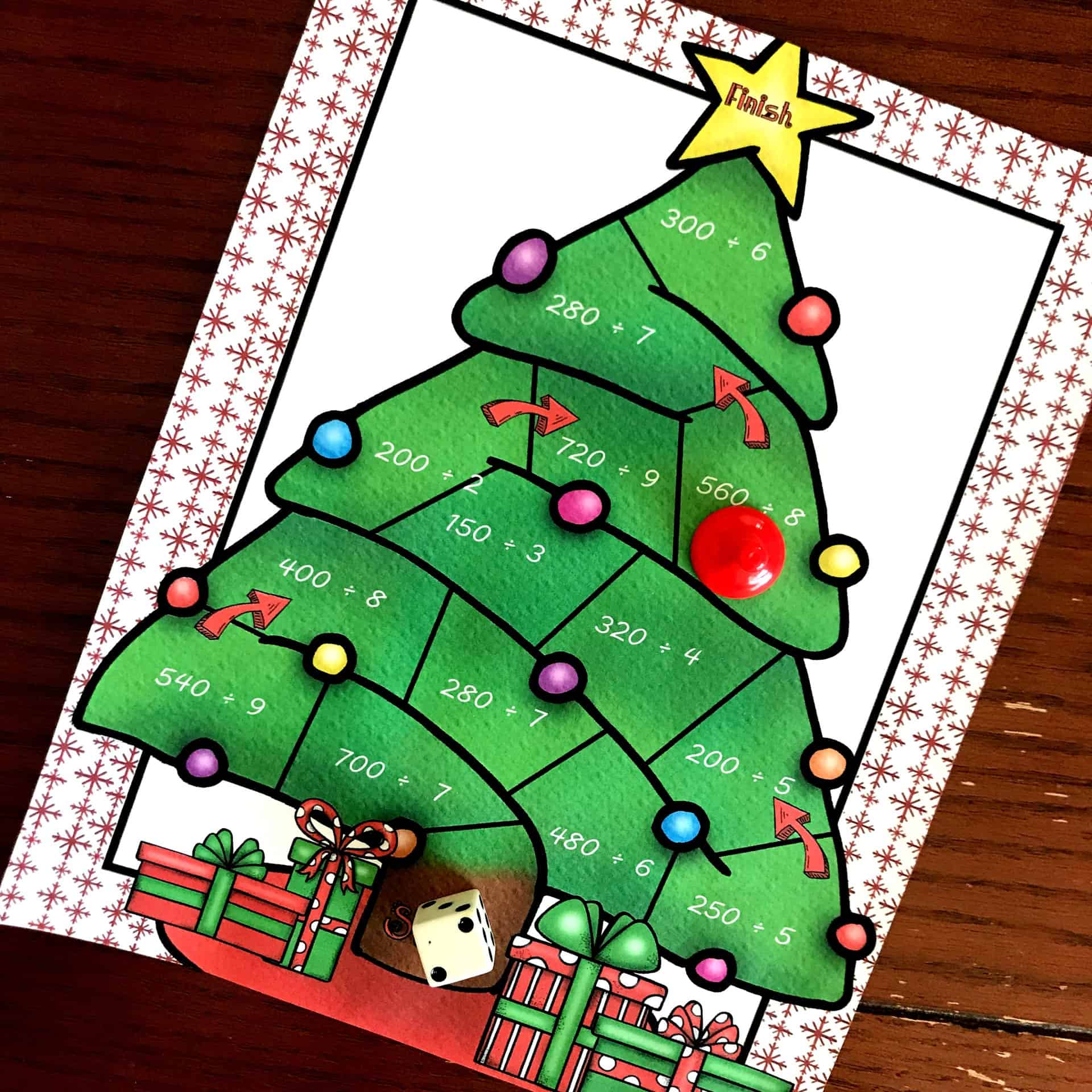

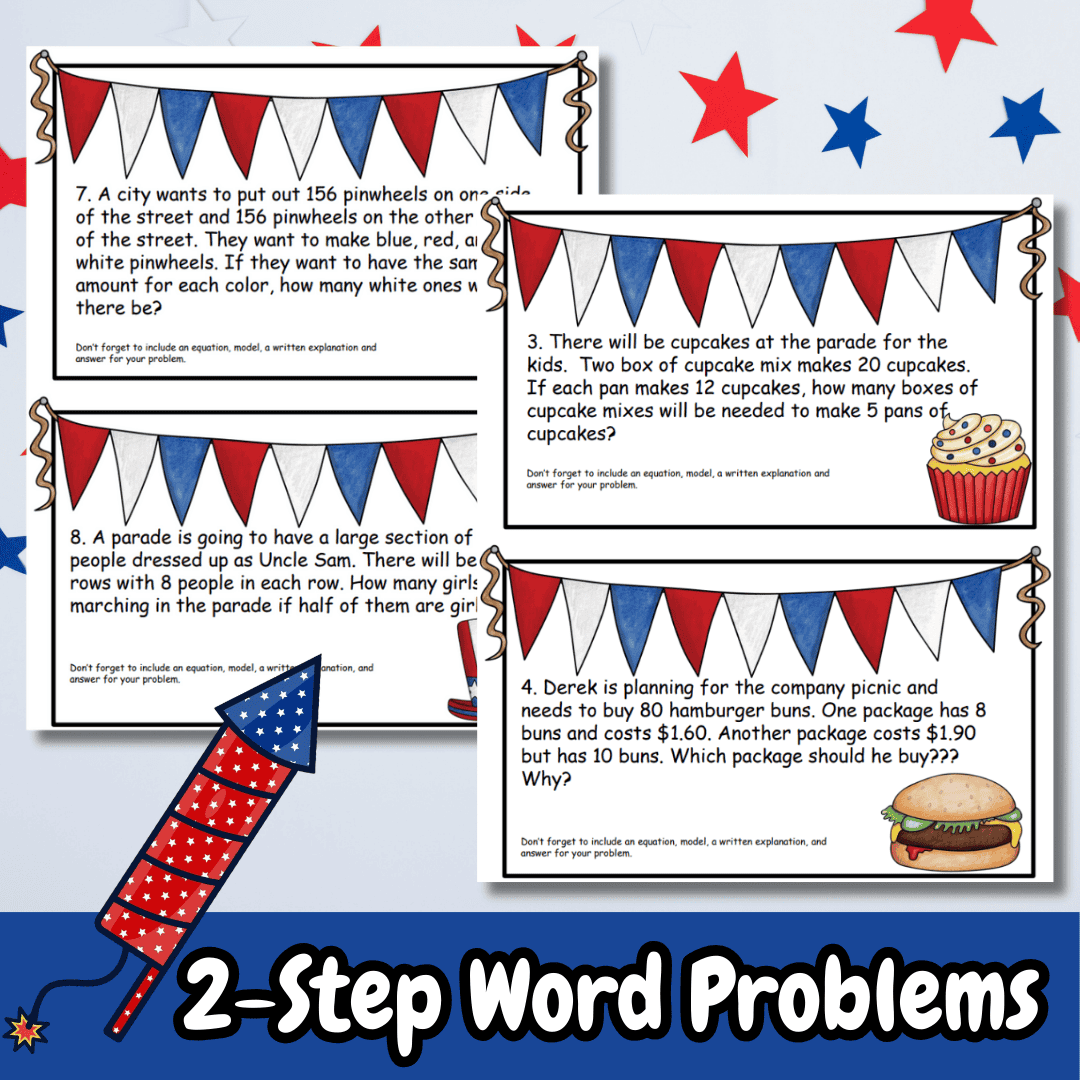

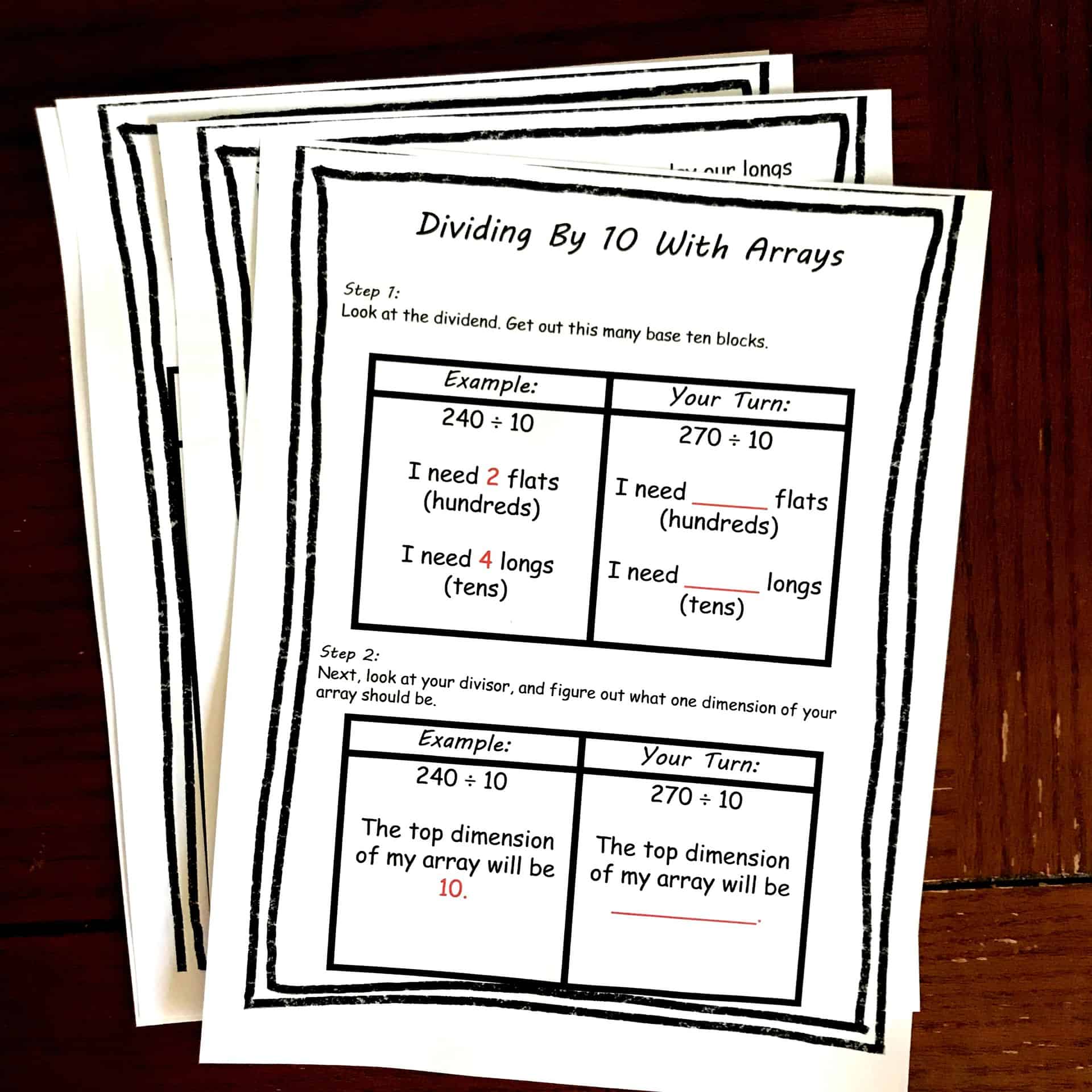

In fact, I have many activities here on this site and in the TeachersPayTeachers storefront that help you teach money skills. When I was little, I remember my Dad going to the bank every Friday evening. He’d deposit his paycheck, take cash out and do whatever other details he needed to do. Who does that anymore?

But, our society has changed significantly in the past several years. Partially hastened by the pandemic, how kids learn money needs to change. If you remember, early on in 2020, it was learned that the covid-19 virus could be transmitted via cash and coins.

So, many stores stopped accepting cash.

But, even for the stores and businesses that have not stopped taking cash, most will tell you that the bulk of the purchases are done with a credit card, debit card or things like Apple Pay or Venmo.

It’s not at all unusual to be faced with an iPad instead of a cash register when you go to complete a purchase.

We really need to adapt how we teach math and money skills. Coins and dollars are important and they are the foundation for money and value. But if we do not teach kids transactional skills and how money actually works, we’re doing them an incredible disservice.

At what age should you teach money skills?

This will vary with the child. A low risk way to get started with some of these is to use gift cards. A child could use a $25 gift card to shop in a store and you could explain all the concepts.

Money Skills for Kids

In addition to the traditional money skills kids need to know, the basic math, consider adding these to your curriculum. Or, providing materials for families to do this at home.

- Credit Cards, Gift Cards and Debit Cards: What is the difference between the two? How do you get one? How do you use one? And, safety/security measures for both.

- Apps to pay: Apple Pay, Venmo, CashApp, Paypal and things like that. What are some common payment apps, how do they work? And, as noted above, safety and security measures when using.

- Interest: What is interest? Paying interest vs earning interest, why does it matter?

- Online Banking: Who goes to a bank branch anymore? We certainly don’t do the bulk of our banking there, like we did in the past. So whether it’s an app or a website, a child should know how to navigate it and use it, safely and securely.

- Online Purchases and Subscriptions: What are they? How do you pay for them? What are the fees?

- Using an ATM: What is it? How does it work? Where does the money come from? Safety and security.

There are other tangent concepts such as credit, building credit, budgeting and more. But, then you are getting more into independent living skills and not just money.

Another idea that comes to mind is online shopping. My 13-year-old often wants to buy things online, and some of the websites look really sketchy to me. So I’ve had to explain to him why the site looks untrustworthy and so on.

If your child has a learning disability, consider adding IEP Goals for Money Skills to their IEP. It is an area often overlooked.

Many banks offer videos and materials online to teach things like this.

With these foundational skills, your child will be on their way to being a financially responsible adult.

Lisa Lightner is an award-winning and nationally-known Special Education Advocate and Lobbyist who lives in suburban Philadelphia. She has or is serving on the Boards of numerous disability and education related organizations including the Epilepsy Foundation and PA Education Voters. She also has testified before State House and Senate committees relating to special education issues and education funding issues.